Lagos, FIRS sign join tax audit agreement

…Sanwo-Olu: ‘Collaboration to check double taxation, widen tax base’

The Lagos State Government has sealed a bilateral agreement with the Federal Government to harmonise tax administration, raise system efficiency and proffer solution to challenges of multiple taxation.

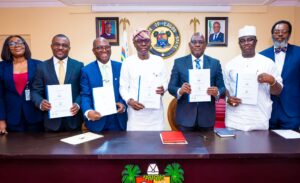

Governor Babajide Sanwo-Olu, on Monday, presided over a ceremony where Federal Inland Revenue Service (FIRS) and Lagos State Inland Revenue Service (LIRS) signed a Memorandum of Understanding (MoU) to establish a joint tax audit system that will address duplication of efforts and facilitate exchange of data that are relevant to enforcement of extant tax laws.

Minister of State for Finance, Mr. Clem Agba, witnessed the agreement signing event held the State House in Marina, which also had Commissioner for Finance, Dr. Rabiu Olowo, Lagos Attorney General, Mr. Moyosore Onigbanjo, SAN, Commissioner for Economic Planning and Budget, Hon. Sam Egube, and Commissioner for Information and Strategy, Mr. Gbenga Omotoso, in attendance.

Aside from offering joint jurisdiction in tax audit and bringing about an integrated system of tax compliance, the scope of the MoU also empowered both tax authorities to exchange information sourced under International Tax Treaties in line with global protocols, while creating a common tax collection platform to eliminate double taxation.

READ ALSO: https://www.thexpressng.com/apc-fighting-for-old-notes-to-buy-votes-pdp/

Sanwo-Olu described the collaboration as “epoch-making”, noting that the conversation for the harmonization of the two agencies’ mandates started about a year ago, based on the need to forge a common front in widening the tax net to raise the country’s tax to GDP ratio.

The governor observed that Nigeria had maintained an unimpressive tax to GDP ratio of between 6 to 8 per cent, despite the yearly record-breaking turnovers by both FIRS and LIRS. This, he said, has mounted pressure on the nation’s resources and created an imbalance in Government’s expenditure. Sanwo-Olu said Nigeria must operate at the same level with other nations within sub-Saharan Africa doing between 14 and 15 per cent in tax to GDP ratio in order to support the Government’s development programmes and improve accountability.

He said: “We have just witnessed an epoch-making ceremony between the Federal Inland Revenue Service and Lagos Inland Revenue Service. This collaboration did not just happen by chance; it is a conversation we started about a year ago with the chairman of FIRS when both parties reviewed their successes and limitations. It was clear there was a need for a relationship to be consummated. Both FIRS and LIRS have been breaking records of their tax collection and administration yearly, but this is not enough. We have an unimpressive tax to GDP ratio, which ranges between six and eight per cent; this is totally unacceptable.

“Studies have shown that there would be better service delivery to the citizens and improvement in efficiency of tax collection when the two agencies work together. The cost of tax collection would be reduced, we would see better customer satisfaction and more resources would be generated for the Government to deliver more dividends of democracy. For us as a State, we are humble by this collaborative effort and we believe our citizens will be the ultimate beneficiaries of this initiative. The MoU is in the best interest of the public, as it affirms the reason why we need to come together and strengthen the cordial working relationship between the two agencies.”

Sanwo-Olu said the bilateral agreement was initiated not to overburden tax-paying citizens, stressing that the objective was to widen the tax base and bring more people to equitability. With a sustainable tax administration system, the Governor said more resources would accrue to the Government to reduce social burden and take care of the vulnerable.

The governor observed that the sizes of Lagos’s budget were significantly lesser than what the State should be appropriating. He said the market study indicated a N5 trillion budget benchmark for the State, given the size of the State economy’s GDP. With the collaborative effort, Sanwo-Olu said Lagos may have been on the right track to raise its budget level to what it should be.

He said: “Our Government will continue to raise the bar, so that we can do a lot more with more resources. This collaboration is not to overburden our citizens; it is to widen the tax base and bring people to equitability. This will reduce social burden, because we would have enough resources to take care of the vulnerable.

“This collaboration is a win-win for both agencies and our citizens. It means the Government can do a lot more for the residents and provide resources to take care of their needs in health, in education, safety and security, and in everything that makes life meaningful to our people. We are set to remove red tape in the entire tax administration. This is another beginning for a mutually beneficial relationship between FIRS and LIRS.”

Agba said the dwindling oil revenue necessitated the need to expand the nation’s tax base to fund development projects. The minister said duplication of efforts by both agencies would lower the efficiency of both Lagos and Federal governments in resource generation, while limiting both parties to collect tax.

The collaboration, the minister said, would not short-change each party, but rather bolster the parties to raise finance to bridge infrastructure gap in their respective domains.

FIRS chairman, Mr. Mohammed Nami, said the MoU would help both agencies to build capacity in respective areas of specialisation while helping Lagos and Federal governments to raise revenues for projects and development programmes.

“We will work together as a team during the investigation and have an automatic exchange of information. With this, we will be able to carry out our mandate seamlessly. As part of the joint operation, we will be able to implement presumptive tax as far as issues of tax administration are concerned,” Nami said.

LIRS chairman, Mr. Ayo Subair, said the collaboration would bring about quick solutions to tax disputes and incidents, thereby creating seamless reconciliation of issues. He listed other expectations to include reduced administration costs for both tax authorities and the elimination of hiding places for recalcitrant taxable persons and entities.