Pascal Oparada

They are seen in every square foot space, even in cities with robust banking services. Close proximity to each other doesn’t matter to them. “It is a survival of the fittest in this business,” Ope Ogedengbe, who operates agency banking, otherwise known as POS business, told this newspaper.

For every N10, 000 withdrawn or deposited, the agents charge between two to three per cent. But the commission charged vary based on the location of the operators. For those operating in rural areas, the charges are as much as five to 10 per cent, findings by this newspaper can reveal.

“Your charges determine how much patronage you get,” Ogedengbe said.

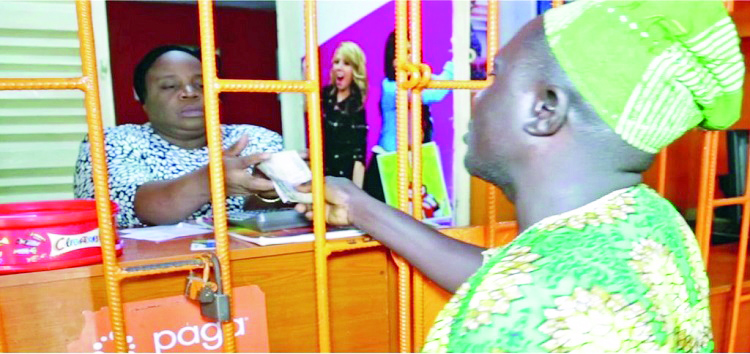

Agency banking, known in Nigerian local parlance, as POS business because of their use of Point of Sale (POS) machines, is relatively new in Nigeria, which many have taken up as means of survival, although the operators complain that the returns are low.

That is what Ogedengbe said as she sat in the kiosk waiting for customers. According to her, she’s doing the job as a means of surviving the harsh economic climate as unemployment spirals out of control in Nigeria.

“My boss pays me N15, 000 monthly. It is barely enough for transportation. Whenever there are no sales, she grumbles and asks where she would get the money to pay me,” she said.

As the Nigerian economy bites harder, many try their hands on whatever venture they think will sustain them for the short term. And the POS business is the latest many have taken up.

Nigeria ranks second highest in the global unemployment rate which stands at 33 per cent as of the last quarter of 2020, according to Bloomberg, quoting the National Bureau of Statistics (NBS).

A third of the 69.7 million-strong labor force in Africa’s most-populous nation are unemployed either because they did nothing or worked for less than 20 hours a week. Another 15.9 million are underemployed. They only worked 40 hours or less in a week.

Introduced in Nigeria in the 2000s by the Central Bank of Nigeria (CBN) to drive the cashless economy, PoS has evolved to include and embrace agency banking in the country.

As banks seek to deepen their penetration into and bring banking to the unbanked and underbanked, they have licensed agents to help them drive their services in rural areas in the country.

About 56 Million Nigerians are without any form of bank accounts.

As of September 27, 2020, the Nigeria Inter-Bank Settlement System (NIBSS), placed the number of adults with a bank verification number (BVN) at 43.6 million. Live data from the World Population Review shows that Nigeria has 99.6 million adults. This means in the year 2020, 56 million (56 per cent) of Nigerian adults are unbanked

The proliferation of agency banking is a temporary relief, analysts say, because it is subject to strict regulations by the CBN. And it is driven more by profit than by financial inclusion.

Last year, the CBN began licensing Payment Service Banks (PSBs) with 9PSB being the first to roll out.

But analysts are worried that the services of the PSBs may also be concentrated in the urban areas, thereby defeating the essence of their existence which is to drive banking in the rural areas.

According to the CBN, the PSBs shall operate in the rural areas, targeting financially excluded persons with no less than 23 per cent financial service touchpoints in such rural areas as defined by the CBN.

Among what the PBSs are licensed to do is to deploy POS devices and ATMs in some areas.

So far, the newest entrant, 9PSB, has not been sighted in any rural area but is rapidly expanding in cities like Lagos, Owerri, Port-Harcourt, and others.

The idea of PSBs is to drive financial inclusion through mobile phones and technology rather than through traditional means.

Operators like Ogedengbe believe that the market is not yet saturated as more people, especially market women and artisans use their services most.

For whatever it is worth, the PoS business is helping salvage Nigerians from the ever-expanding unemployment and fallen deeper into the poverty line.